Yesterday, the Federal Reserve delivered the worst of both world’s, as far as Wall Street is concerned.

And the 25 basis point increase in benchmark interest rates doesn’t even count–since that was what the market was expecting.

First, the Fed drew attention to probability of at least a growth slowdown in 2019 and heightened fears of a recession in 2019 or 2020. The Fed’s dot plot summary of projections from Fed officials showed a median expectation of 3% real (that is after accounting for inflation) in 2018 and just 2.3% in 2019. That’s down from the 3.1% growth rate for 2018 and the 2.5% growth rate for 2019 that the Fed’s dot plot showed at the central bank’s September meeting. The market is even more pessimistic about growth in 2019 than the Fed is, but the downward shift in the Fed’s projections just confirms the market’s belief ins lower slow growth in 2019.

Second, the market was disappointed that the Fed didn’t respond more forcefully to signs of a slowdown. The market had already priced in a shift to two interest rate increases in 2019–rather than three–and was looking for the Fed to move to just one interest rate increase in 2019. The market didn’t get that–the Fed did signal two instead of three interest rate increases in 2019 but shied away from moving more forcefully.

And third, the Fed didn’t address at all a growing fear among market participants that the Fed’s decision to reduce the size of its asset portfolio is a significant tightening of the money supply–even more significant than shifts in the Fed’s benchmark interest rate. In Wednesday’s post-announcement press conference Fed chair Jerome Powell said he wasn’t looking to slow the pace at which the Fed is reducing the size of its balance sheet. (The Fed reduces its balance sheet by selling Treasuries and other assets on the market–or not buying assets to replace those that mature. That has the effect of pulling liquidity, cash, out of the economy and putting it instead on the Fed’s books.) The Fed is currently reducing the size of its balance sheet by $50 billion a month and Powell’s statement indicated that the Fed is not interested at this moment in reducing the size of that tightening. There’s been increasing worry recently that a lack of liquidity on down days for stocks is making downward moves larger since potential buyers lack the liquidity to step up and purchase. If there is a structural reason to fear that the growling bear market is going to get really fierce, it centers around this lack of liquidity. And on Wednesday the Fed struck the market as completely oblivious to the danger.

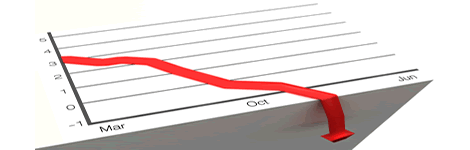

Today, Thursday December 20, the Standard & Poor’s 500 stock index was down another 2.08% as of 2:30 p.m New York time. The Dow Jones Industrials were lower by 2.32%. The NASDAQ Composite had dropped 2.40% and the small company Russell 2000 was lower by 1.74%.

The drop in the S&P 500 has taken the index well below the February 8 and April 2 closing lows at 2581. As of 2:30 p.m. the S&P 500 stood at 2454.

A close below the lows for 2018 for a second day–the index closed at 2507 yesterday–would exacerbate fears that this bear isn’t anywhere near done. And that would likely lead to more selling by those analysts who said, before the Fed meeting, that they saw signs that the market had put in a bottom.