This morning it sure looked like U.S. stocks were going to bounce back from yesterday’s beating and from a deeply negative open.

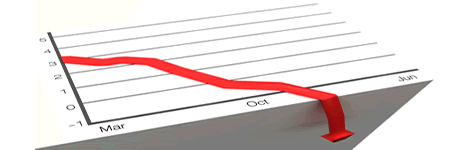

After opening down 2.28% at 9:31 a.m. New York time and then sinking even lower to down 3.54% by 10:35, the Standard & Poor’s 500 climbed out of that hole to show a gain of 1.29% for the day at 12:39 p.m.

But then the news broke that California is currently monitoring 8,400 people for signs of exposure to the coronavirus after they traveled to Asia.

And we were off to the races on the downside. The S&P 500 closed for the day, February 27, down 4.42% at 2978.76.

Yesterday, the index plunged to break below its 50-day moving average at 3274.

Today, the index broke below the 200-day moving average at 3096.86.

Normally, these technical levels, the 50-day and the 200-day moving averages, would supply support to the market, creating at least a pause in the selling or maybe even an oversold bounce.

But with bad news on the coronavirus currently driving stock prices, technical levels and support are, for the moment, out the window.

Tomorrow we might expect a bounce or some positive move after a plunge like today. Lots of stocks are short-term oversold by all the technical indicators. But I doubt that there’s much enthusiasm for buying going into the weekend, given how unpredictable the coronavirus news flow is. I don’t know that we’ll get another huge wave of selling unless there’s some more big bad news. But I’d be very surprised to see stocks move significantly higher into the weekend.