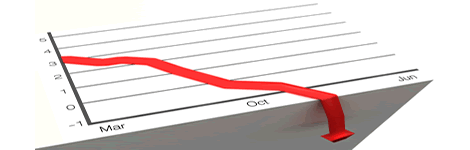

At 3:30 p.m. New York time the Dow Jones Industrial Average was down a big 2.39% or 632 points. The Standard & Poor’s 500 was lower by 2.55%. The NASDAQ Composite Index fell 3.16%. (The S&P 500 closed down 3.29%. The Dow was lower by 832 points or 3.15%. The Nasdaq closed off 4.08%.)

The rout came on fears that the U.S.-China trade war would cut into U.S., Chinese, and global growth. Big U.S. exporters Boeing (BA) and Caterpillar (CAT) fell 4.66% and 3.84%, respectively.

And tomorrow?

The key to market direction for the short-term may well be tomorrow’s Consumer Price Index inflation numbers. After today’s ambiguous Producer Price Index reading–which showed inflation at the wholesale level resuming an upward trend after a summer easing but at a relatively modest rate–the bond market will be looking to see if rising inflation justifies a further dip in bond prices and a continued increase in bond yields.

What was interesting to me about today’s 600-point drop in the Dow and the plunge in technology shares (and consequently in the NASDAQ) is that it took place against a background of stable bond prices and yields. The yield on the 10-year Treasury note was unchanged for the day at 3.20%. (The 2-year Treasury note closed with a yield of 2.86%.)

Rising bond yields–fueled by fears of inflation, a huge auction schedule ($230 billion) in Treasuries this week, and comments from the Federal Reserve that pointed to an interest rate increase at the December meeting and then three more times in 2019–have been the fundamental factor leading to weakness in stocks. Today, though, Treasury prices were unchanged while stocks still fell. If we get stronger than expected inflation numbers out of the CPI tomorrow that would restoke the fundamental fears in the bond market and lead to higher yields on lower Treasury prices. And that would provide enough fuel for at last another couple of days of selling. (Economists surveyed by Briefing.com are looking for a 0.2% month to month increase in the CPI tomorrow for September.)

I would note that the CBOE S&P 500 Volatility Index (VIX) spiked to 22.96 today, a 43.95% gain. That’s a solid indication that traders were hedging against a further drop in U.S. stocks.