Here’s what I wrote today when I added Vulcan Materials to my Special Report “10 new stock ideas for a old rally” on my subscription JubakAM.com site.

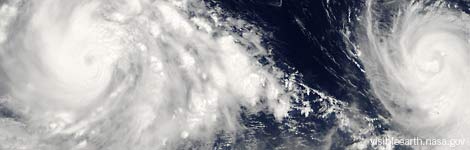

Pick #3; Vulcan Materials (VMC). As stock prices have kept climbing, it’s become harder and harder to find good profit opportunities. Even conservative defensive plays have moved, in many cases, to substantial premiums. So I’ve been looking for anything that offers a substantial, under-appreciated boost to revenue–such as Hurricanes Helene and Milton. Milton promised to be the worst storm to hit western Florida in more than 100 years when it came ashore near Tampa, hitting a region already devastated by Hurricane Helene just weeks ago. Helene was a huge disaster with hundreds of lives lost and billions of property destroyed. I devoutly wish that fewer people die in Milton and that communities somehow escape the worst of the storm. (The storm has just been downgraded to a Category 1 and early reports show very few deaths, thank goodness.) But when the massive reconstruction starts after the storms have passed and emergency workers have cleared the streets, there will be massive demand for Vulcan’s products. Vulcan Materials is the largest producer of construction aggregates–primarily crushed stone, sand and gravel in the United States with an estimated 10% share of a fragmented market.It doesn’t pay to ship aggregates long distances so the sector is made up of regional producers. For the current moment, what’s important is the company’s strength in the Southeast. In 2023 Vulcan’s top revenue-producing states included Georgia (#3), Tennessee (#4), Florida (#6), Alabama (#8), South Carolina (#9), and North Carolina (#10). Vulcan has been making acquisitions to expand its footprint in the Southeast. For example, in 2017 it acquired Aggregates USA, to expand its market presence in Florida, Georgia, and South Carolina.” This regional dominance translates into very solid growth for the bottom line. In 2023, Vulcan Materials generated over $2 billion in Adjusted EBITDA, a 24% increase over the prior year. In the second quarter of 2024, the aggregates segment saw gross profit margin expand 120 basis points. Cyclical stocks are always hard to value because their price-to-earnings ratios soar at the bottom of the cycle when earnings are scant and then fall to what seem to be reasonable levels at the top of the cycle just when earrings are about to decline. The stock now trades with a trailing 12-month PE ratio of 34.92. The ratio was 42.54 in 2021, near the bottom for this cycle and 18.42 in 2018 near the top. Vulcan Materials has been a member of my Jubak Picks Portfolio site March 1, 2012. It was up 45% since that pick as of October 10.