May 22, 2019 @ 7:39 pm | Breaking News, Volatility, You May Have Missed |

Minutes from the Federal Reserve’s April 30-May 1 meeting showed officials at the U.S. central bank inclined toward patience and to keeping the current wait-and-see policy in place “for some time.” Adding to the dovish tone of the minutes, many Fed...

April 10, 2019 @ 7:41 pm | Breaking News, Volatility |

According to the minutes of the Federal Reserve’s March meeting, released this afternoon, everything is on the table. Here’s a quote that sums up the thrust of the minutes, in my opinion.“Several participants noted that their views of the appropriate...

March 22, 2019 @ 7:44 pm | Breaking News, Volatility, You May Have Missed |

It was always implicit in the Federal Reserve’s decision on Wednesday that all interest increase in 2019 were off the table and that the central bank would end its $50 billion a month balance sheet run off in September. Yeah, lower interest rates are a boost to...

March 21, 2019 @ 7:16 pm | Breaking News, Volatility, You May Have Missed |

The Federal Reserve’s announcement that it would hold interest rates steady for 2019, that it would end its program to wind down the size of its balance sheet by $50 billion a month in September, and that it projects the economy will grow by just 2.1% in 2019...

March 21, 2019 @ 7:05 pm | Breaking News, Volatility, You May Have Missed |

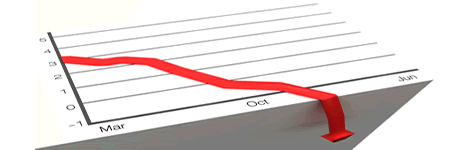

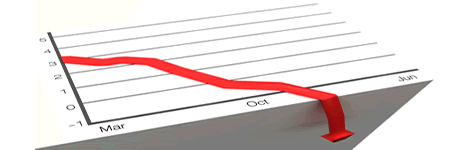

Let’s remind ourselves of exactly how big a policy u-turn the Federal Reserve has steered in the last three months. In December the Fed was looking at 2 interest rate increases in 2019 and an announcement of an end to its balance sheet run off by, maybe,...

March 20, 2019 @ 7:24 pm | Breaking News, Volatility, You May Have Missed |

Today, March 20, the Federal Reserve left benchmark interest rates at the current 2.25% to 2.5% range at the meeting of the Open Market Committee, but cut its forecast for U.S. economic growth in 2019 and voiced concern about slowing consumer and business spending....

March 18, 2019 @ 7:58 pm | Breaking News |

According to a Bloomberg survey of 32 economists, the Federal Reserve will remain on hold until September. Then it will raise interest rates one final time. And that will bring an end of the recent cycle of interest rate increases. The financial markets beg to differ....

February 20, 2019 @ 7:40 pm | Breaking News, Update, You May Have Missed |

As surprises go today’s release of the Federal Reserve’s minutes from its January meeting doesn’t rank up there with Agatha Christie. (Remember 10 Little Indians? Where the murderer turns out to be someone who had earlier faked his own murder?) But...

February 13, 2019 @ 7:32 pm | Breaking News, Volatility, You May Have Missed |

For January, headline Consumer Price Index (CPI) inflation was unchanged, thanks to falling oil prices-the energy component of the index was down 3.1% for the month. The Core CPI, which excludes more volatile food and energy prices and is closer to the PCE inflation...

February 5, 2019 @ 6:48 pm | Breaking News, Volatility |

A number of Wall Street and big international banks are forecasting a drop in the dollar as a result of the Fed’s decision to back off on raising interest rates in 2019. Morgan Stanley, for example, says that the dollar has peaked and has forecast the yen...

February 1, 2019 @ 7:20 pm | Breaking News, Volatility, You May Have Missed |

Once upon a time–as late as 2018–the consensus thinking in financial markets was that the Federal Reserve was but the first central bank to raise interest rates. Other central banks, most notably the European Central Bank, (but not the Bank of Japan, which...

February 1, 2019 @ 7:14 pm | Breaking News, You May Have Missed |

Last week the Federal Reserve signaled a huge policy change–no (or at most one) interest rate increase in 2019 and flexibility on continuing/ending the $50 billion a month program to reduce the size of the Fed’s balance sheet. Markets cheered the shift on...

January 31, 2019 @ 7:28 pm | Breaking News, Volatility, You May Have Missed |

The market has priced in just about a zero percent change of an interest rate increase from the Federal Reserve in 2019. In fact, looking out through all of 2019 and into 2020, the financial markets believe there’s more chance of an interest rate cut than of a...

January 30, 2019 @ 7:29 pm | Breaking News, Volatility, You May Have Missed |

Today the financial markets are in love with the idea that the Federal Reserve will raise rates no more than once in 2019–and more likely zero. And that the central bank will re-examine its policy of letting its balance sheet run off to the tune of $50 billion a...

January 30, 2019 @ 7:20 pm | Breaking News, Volatility, You May Have Missed |

It’s hard for me to see the Federal Reserve’s statement today after the meeting of the Open Market Committee, and then Fed chair Jerome Powell’s presentation at the most-meeting press conference, as anything other than capitulation to the financial...

January 30, 2019 @ 7:08 pm | Breaking News, Volatility, You May Have Missed |

Today the Federal Reserve’s Open Market Committee said it will The Federal Reserve said it will be “patient” on any future interest-rate increases. moves. And it will be flexible and “prepared to adjust any of the details for completing balance sheet...

January 9, 2019 @ 7:48 pm | Breaking News, Volatility |

So what, exactly, didn’t the markets like about the minutes of the Federal Reserve’s December meeting? After an initial spike to the day’s high at 2595 at 2:09 p.m. New York time, nine minutes after the 2:00 p.m. release of the minutes, the Standard &...

January 9, 2019 @ 7:42 pm | Breaking News, Volatility |

In the last few days the heads of the Chicago, Boston, Atlanta, St.Louis, Dallas, and Cleveland Federal Reserve Banks have all said that the Federal Reserve will be patient on any interest rate increases in 2019 with even the most hawkish officials, such as...

January 7, 2019 @ 6:50 pm | Breaking News, Volatility, You May Have Missed |

U.S. stocks moved toward a key test today with the Standard & Poor’s 500 approaching the 2550 to 2600 level that signals the top of the recent volatility range and likely technical resistance. If the index breaks above this level, the market could run...

January 7, 2019 @ 6:42 pm | Breaking News, Volatility, You May Have Missed |

It’s an extraordinarily busy week for the Federal Reserve–verbiage wise. Saturday, January 5, John Williams, head of the New York Federal Reserve Bank, Raphael Bostic of the Atlanta Fed, and Mary Daly of the San Francisco Red all spoke. Today, January 7,...

January 4, 2019 @ 7:44 pm | Breaking News, Volatility |

The U.S. economy added 312,000 jobs in December, the Labor Department reported this morning. The government statisticians also revised November’s report to show the addition of 176,000 jobs instead of the prior report of 155,000. Economists surveyed by...

January 2, 2019 @ 7:57 pm | Breaking News, Volatility, You May Have Missed |

China and other export-oriented Asian economies delivered really grim news on growth last night and yet U.S. stocks have refused to move into the red. As of 2:20 p.m. New York time on Thursday the Standard & Poor’s 500 index was up 0.07% The NASDAQ...

December 20, 2018 @ 7:01 pm | Breaking News, Volatility, You May Have Missed |

Yesterday, the Federal Reserve delivered the worst of both world’s, as far as Wall Street is concerned. And the 25 basis point increase in benchmark interest rates doesn’t even count–since that was what the market was expecting. First, the Fed drew...

December 17, 2018 @ 7:09 pm | Breaking News, Volatility |

Maybe that should be “wild cards.” First, there’s President Donald Trump’s threat to shut down about 25% of the government on December 22 if Congress doesn’t include $5 billion for his border wall in its bill to fund such government units...

December 10, 2018 @ 5:57 pm | Breaking News, Volatility, You May Have Missed |

I dare you to find something global financial markets aren’t worried about. And, moreover, many of the worries are re-enforcing each other today. So, for example, we’ve got U.S. Trade Representative Robert E. Lighthizer, saying on Sunday TV the the 90 day...

December 7, 2018 @ 7:39 pm | Breaking News, Volatility, You May Have Missed |

The Federal Reserve’s interest rate setting body, the Open Market Committee, meets on December 19 to 1) decide on a 25 basis point boost in benchmark interest rate, and 2) to tell financial markets what to expect on interest rate increases for 2019. It’s...

December 7, 2018 @ 7:33 pm | Breaking News, Volatility, You May Have Missed |

This morning the November jobs report came in softer than expected–and that pretty much removed the last factor pushing the Federal Reserve toward aggressively raising interest rates in 2019. For November the economy added 155,000 jobs. That is still a strong...

December 4, 2018 @ 7:45 pm | Breaking News, Volatility, You May Have Missed |

It’s hard to take a step back on a day when the Dow Jones Industrial average closed down more than 700 points (and 3.10%), but that’s exactly what I’m going to suggest. The huge sell off was driven by three major factors in my opinion. First, the...

November 28, 2018 @ 6:52 pm | Breaking News, Volatility, You May Have Missed |

Sometimes the market hears what it wants to hear and then storms higher (or lower) on what is little more than a hint. In the short run that doesn’t much matter since the oftentimes huge gains are real and investors can and do take them to the bank. In the...

November 26, 2018 @ 8:07 pm | Breaking News, Volatility, You May Have Missed |

On December 13 the European Central Bank will decide whether to cap its $2.9 trillion program of bond buying as planned. The bank had decided that Europe’s economy was strong enough for the central bank to wind down its purchases of bonds that have kept interest...