January 8, 2019 @ 7:50 pm | Breaking News, INCY, IONS, Jubak Picks Portfolio, NKTR, Update, Volatility |

Last week the biotech sector seemed in freewill. Bristol Myers Squibb (BMY) had made a deal to buy Celgene (CELG) at a whopping 54% premium to Wednesday’s close and the sector dropped on the news. The prevailing theory was that the deal removed one hungry big...

January 8, 2019 @ 7:42 pm | Breaking News, Volatility |

Overnight Samsung Electronics announced that for the quarter that ended in December quarterly profit and revenue missed estimates on sputtering demand for memory chips. Operating income fell to 10.8 trillion ($9.6 billion) won for the South Korean giant. That was well...

January 7, 2019 @ 6:50 pm | Breaking News, Volatility, You May Have Missed |

U.S. stocks moved toward a key test today with the Standard & Poor’s 500 approaching the 2550 to 2600 level that signals the top of the recent volatility range and likely technical resistance. If the index breaks above this level, the market could run...

January 7, 2019 @ 6:42 pm | Breaking News, Volatility, You May Have Missed |

It’s an extraordinarily busy week for the Federal Reserve–verbiage wise. Saturday, January 5, John Williams, head of the New York Federal Reserve Bank, Raphael Bostic of the Atlanta Fed, and Mary Daly of the San Francisco Red all spoke. Today, January 7,...

January 4, 2019 @ 7:44 pm | Breaking News, Volatility |

The U.S. economy added 312,000 jobs in December, the Labor Department reported this morning. The government statisticians also revised November’s report to show the addition of 176,000 jobs instead of the prior report of 155,000. Economists surveyed by...

January 3, 2019 @ 7:22 pm | Breaking News, FXY, Jubak Picks Portfolio, Volatility |

On December 27 I switched to the Invesco Currency Shares Japanese Yen ETF (FXY) from the Vanguard FTSE Developed Markets ETF (VEA) in my Perfect 5 ETF Portfolio (on my subscription sites JugglingWithKnives.com and JubakAM.com) in an effort to get more yen exposure...

January 3, 2019 @ 7:09 pm | Breaking News, Volatility |

Last night’s warning from Apple that sales for the December quarter would be well below the company’s earlier guidance bled into a weaker than expected reading this morning from the Purchasing Managers Index for the Manufacturing sector. The ISM...

January 2, 2019 @ 11:16 pm | AAPL, Breaking News, Jubak Top 50 Portfolio, Volatility |

Will Apple’s (AAPL) warning spook stocks tomorrow, Thursday, January 3, to a degree that bad economic news out of China didn’t today? After the close in New York Apple CEO Tim Cook dramatically lowered the company’s estimates for sales in the...

January 2, 2019 @ 7:57 pm | Breaking News, Volatility, You May Have Missed |

China and other export-oriented Asian economies delivered really grim news on growth last night and yet U.S. stocks have refused to move into the red. As of 2:20 p.m. New York time on Thursday the Standard & Poor’s 500 index was up 0.07% The NASDAQ...

January 2, 2019 @ 7:53 pm | Breaking News, Volatility, You May Have Missed |

It’s not just China anymore. Unfortunately. The Caixin Media and IHS Markit Purchasing Managers Index for China’s manufacturing sector fell to 49.7 in December from 50.2, its lowest reading since May 2017. That confirms a trend seen in the official...

December 28, 2018 @ 6:07 pm | Breaking News, ISRG, Volatility, You May Have Missed |

Once stocks have wound up in the jaws of a bear market, the most pressing question is when/where will it end? Which is tough to predict because we have a relatively small data set to project from–we’ve only had 12 bear markets (using the 20% drop from a...

December 28, 2018 @ 6:01 pm | Breaking News, Volatility |

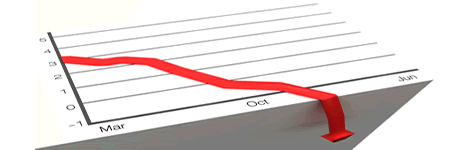

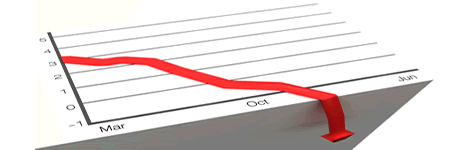

If you’re thinking of doing some bottom fishing in a belief that the bear market might be nearing a bottom or that the recent Santa Claus rally could last into the first half of January, I’d suggest you take a look at some charts, either of individual...

December 27, 2018 @ 7:32 pm | Breaking News, Volatility |

I don’t use options on this site or in any of the Jubak Picks portfolios. But I do in the Volatility Portfolio on my paid JugglingWithKnives.com and JubakAM.com paid sites. This week I’ve bought Put Options–which go up in price when the underlying...

December 27, 2018 @ 7:23 pm | Breaking News, Volatility |

On my paid sites, JugglingWithKnives.com and JubakAM.com I run and track a simple five ETF portfolio called, immodestly the Perfect 5 ETF Portfolio. In the last week, I’ve made the following shifts: Increasing my allocation to 25% in the Goldshares SPDR ETF...

December 27, 2018 @ 6:54 pm | Breaking News, Volatility |

If you’re trying to figure out this market–and who isn’t?–down 700 points on the Dow on Monday; up 1000 on Wednesday, down 400 points on Thursday before finishing up 250 points, I’d suggest starting with the observation that this bear...

December 24, 2018 @ 6:11 pm | Breaking News, Volatility, You May Have Missed |

And Merry Christmas! to you too. The stock market delivered a lump of coal on Christmas Eve. (Does this mean the financial markets are part of the dastardly war on Christmas? Say it ain’t so, Goldman Sachs!) The Standard & Poor’s 500 index closed down...

December 20, 2018 @ 7:01 pm | Breaking News, Volatility, You May Have Missed |

Yesterday, the Federal Reserve delivered the worst of both world’s, as far as Wall Street is concerned. And the 25 basis point increase in benchmark interest rates doesn’t even count–since that was what the market was expecting. First, the Fed drew...

December 18, 2018 @ 7:34 pm | Breaking News, Volatility, You May Have Missed |

Monday’s big drop in U.S. stocks was unusual in this period of frequent market routs–and unusual in an important way. Even as the market has tumbled day after day, investors haven’t seen a big 90% down day of the kind that signals a (perhaps temporary) capitulation...

December 18, 2018 @ 7:28 pm | Breaking News, Volatility, You May Have Missed |

Hope you weren’t hoping for good news from President Xi Jinping’s speech Tuesday to an audience of party officials, military honchos, and business leaders on the 40th anniversary of Deng Xiaoping’s Reform and Opening Up campaign that unleashed China’s economy. First,...

December 17, 2018 @ 7:09 pm | Breaking News, Volatility |

Maybe that should be “wild cards.” First, there’s President Donald Trump’s threat to shut down about 25% of the government on December 22 if Congress doesn’t include $5 billion for his border wall in its bill to fund such government units...

December 14, 2018 @ 6:52 pm | Breaking News, Volatility, You May Have Missed |

I recently noted that I thought stocks wanted to climb, and would through the end of the year–if news let them. Well, this morning, the news has put a big downward thumb on the scale. First off, November retail sales grew 8.1% year over year, China’s...

December 13, 2018 @ 6:43 pm | Breaking News, Volatility, You May Have Missed |

After yesterday’s bounce in riskier bounce-worthy stocks, today the U.S. market is seeing a slight pull back. At 1:30 p.m. New York time the Standard & Poor’s 500 is off 0.34% and the Dow Jones Industrial Average is lower by 0.05%. The NASDAQ...

December 13, 2018 @ 6:29 pm | Breaking News, Volatility |

Economists surveyed by Briefing.com are expecting the 8:30 a.m. New York time report on November retail sales to show month to month growth of 0.2%. That wouldn’t be quite so likely to disappoint the market except that retail sales climbed 0.8% month to month in...

December 12, 2018 @ 6:44 pm | Breaking News, Volatility, You May Have Missed |

Bounce, yes. Rally, maybe. What the difference? Conviction and duration. The wider market isn’t sure that the bad news on the U.S. China trade war is over and doesn’t want to get blind-sided. That’s why the broad indexes such as the Standard &...

December 10, 2018 @ 6:04 pm | Breaking News, Volatility |

U.S. stocks after being deep in the red this morning, came roaring back this afternoon. Or at least technology shares did. The Standard and Poor’s 500, which had been as low as 2583 today, climbed back to close at 2637. The swing from high of the day to low was...

December 10, 2018 @ 5:57 pm | Breaking News, Volatility, You May Have Missed |

I dare you to find something global financial markets aren’t worried about. And, moreover, many of the worries are re-enforcing each other today. So, for example, we’ve got U.S. Trade Representative Robert E. Lighthizer, saying on Sunday TV the the 90 day...

December 7, 2018 @ 7:39 pm | Breaking News, Volatility, You May Have Missed |

The Federal Reserve’s interest rate setting body, the Open Market Committee, meets on December 19 to 1) decide on a 25 basis point boost in benchmark interest rate, and 2) to tell financial markets what to expect on interest rate increases for 2019. It’s...

December 7, 2018 @ 7:33 pm | Breaking News, Volatility, You May Have Missed |

This morning the November jobs report came in softer than expected–and that pretty much removed the last factor pushing the Federal Reserve toward aggressively raising interest rates in 2019. For November the economy added 155,000 jobs. That is still a strong...

December 7, 2018 @ 7:24 pm | Breaking News, Update, Volatility, You May Have Missed |

To the surprise of many, OPEC & Friends–what’s known as OPEC+–agreed to cut production by 1.2 million barrels a day beginning in 2019. This was a bigger cut than the 1 million barrels a day that commodity markets had expected. Oil prices and oil...

December 6, 2018 @ 2:33 pm | Breaking News, Update, Volatility, You May Have Missed |

On a day like today–when U.S. stocks have resumed their downward plunge–the Standard & Poor’s 500 was off 1.91% as of 1:30 p.m. New York time and the Dow Jones Industrial Average was lower by 2.08%–it’s important to remember that the...