Shares of Apple (AAPL) climbed 0.21% to lead the Technology Select Sector SPDR ETF (XLK) higher by 0.40% as of 2 p.m. trading in New York.

That helped disguise what is otherwise a return to the risk off trading of Monday after Tuesday’s rally–although with smaller declines than on Monday.

The Standard & Poor’s 500 index was off 0.34% and the Dow Jones Industrial Average was lower by 0.81% as stocks of U.S. exporters continued to get pounded. Shares of Caterpillar (CAT) were down 1.79% and shares of Deere (DE) fell 1.49%. The financial sector, which plays tag with the Technology sector for the biggest weighting in the S&P 500 from day to day, tumbled 1.68%.

Unlike Monday there were some pockets of strength–lithium stocks were ahead, for example, with Albemarle (ALB) higher by 2.03% and SQM (SQM) up 2.44%.

But by and large money continued to move into risk hedges. Gold climbed 2.09% to $1515.20 an ounce and silver rose to $17.16 an ounce, a gain of 4.35%. Barrick Gold (GOLD) rose 3.39% and First Majestic Silver soared 8.19%.

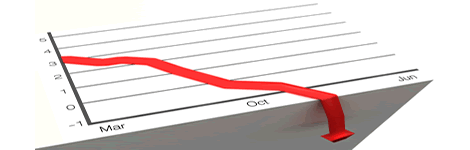

Bond prices rose and yields fell in the Treasury market as investors continued to look for safety. The yield on the 10-year Treasury rose fell to 1.68% and the yield on the 2-year Treasury hit 1.57%. The narrowing gap between the yields on the 10-year and 2-year Treasuries increased fears that we’ll soon see an inversion of the yield curve (where short-term yields rise above long-term yields) that frequently signals a recession. (I don’t think this is a reliable recession indicator right now, however, because cash flows are being driven by speculative fear about the results of the U.S.-China trade war.)

Oil continued to fall on the logical conclusion that a slowing global economy will reduce demand for crude. U.S. benchmark West Texas Intermediate dropped 4.35% to $51.20 a barrel. International benchmark Brent plunged 4.36% to $56.37 a barrel.

The U.S. dollar slipped with the Dollar Spot Index (DXY) dipping 0.09%.