October 9, 2023 @ 5:37 pm | Breaking News, Dividend Income Portfolio, Jubak Picks Portfolio, PXD |

The Wall Street Journal has reported that Exxon Mobil (XOM) is in advanced talks to buy Pioneer Natural Resources (PXD) in a deal valued at $60 billion. Pioneer currently has a market cap of $55 billion. Throw in the debt that Exxon would be buying and there’s...

June 22, 2023 @ 1:51 pm | Breaking News, COP, Dividend Income Portfolio, DVN, Jubak Picks Portfolio, PXD |

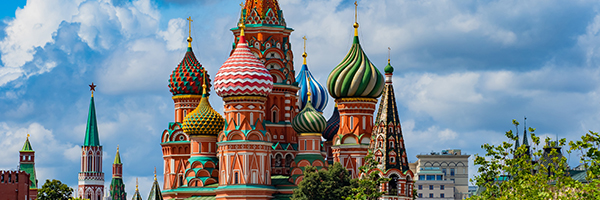

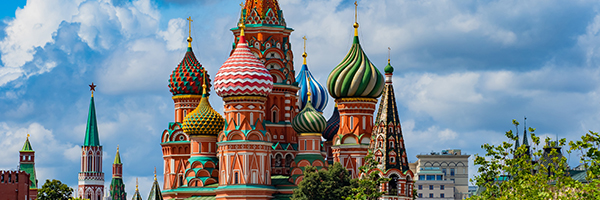

My baseline assumption is that Russia will cheat on its promises to cut oil production whenever and wherever it can. The country is crushed between the need for more oil revenue to finance the war in Ukraine and falling oil prices. The one way out of that dilemma is...

May 8, 2023 @ 10:34 pm | Breaking News |

Today I posted my two-hundred-and-seventieth YouTube Video: Trend of the Week Where Is All That Oil Cash Going to Go? Want to grow your portfolio and protect it too? In the toughest investing market in 40 years? Grab my eBook, Your Best Investing Strategy for the Next...

April 10, 2023 @ 12:54 pm | Breaking News, Dividend Income Portfolio, Jubak Picks Portfolio, PXD |

The Wall Street Journal reported Friday, April 7, that Exxon Mobil (XOM) has held talks with Pioneer Natural Resources (PXD) about a possible acquisition. The Journal reported that Exxon also has discussed a potential acquisition with at least one other company as the...

April 4, 2023 @ 10:54 pm | Breaking News |

On Sunday, April 2 OPEC+ announced a surprise oil production cut of more than 1 million barrels a day. The organization had not so long ago promised that it would hold supply steady. Saudi Arabia led the move by pledging its own 500,000 barrel-a-day supply reduction....

March 27, 2023 @ 11:09 pm | Breaking News, COP, Jubak Picks Portfolio, PXD |

Oil rallied today, Monday, March 27, for the first time in, well, quite a while. Oil is likely to finish with a loss in March, for a fifth monthly drop. So today’s move, which saw West Texas Intermediate jump by almost 55, marked quite a shift in direction. You...

February 28, 2023 @ 11:05 pm | Breaking News, Dividend Income Portfolio, Jubak Picks Portfolio, PXD |

On Friday, shares of Pioneer Natural Resources (PXD) fell on a Bloomberg story reporting rumored talks between the Permian Basin oil shale producer and Appalachian natural gas producer Range Resources (RRC). On Monday shares of Pioneer rebounded as the company denied...

February 23, 2023 @ 10:20 pm | Breaking News, Dividend Income Portfolio, Jubak Picks Portfolio, PXD |

Wednesday, February 22, Pioneer Natural Resources (PXD) reported better-than-expected adjusted earnings for the fourth quarter of 2022 while revenues came up short of Wall Street estimates. Revenue was still up 18% year-over-year to $5.1 billion. Fourth quarter net...

October 5, 2022 @ 7:49 pm | Breaking News, USO |

Today, Wednesday, October 5, OPEC and its allies, including Russia, approved a two million barrel-a-day cut in oil production. This is the largest cut in production since the onset of the pandemic. Here’s the key paragraph in the OPEC+ statement: “Adjust...

October 3, 2022 @ 11:26 pm | Breaking News |

All it takes is a report that OPEC+, the group of oil-producing countries that includes Saudi Arabia and Russia, is considering a big cut in production at its meeting this week to send oil and oil stocks off to the races. As of noon New York time, on Monday, U.S....

August 6, 2022 @ 12:49 pm | COP, Jubak Picks Portfolio, PXD |

I’ve seen several comments on the site asking this question. I assume we’re talking about oil stocks in the short- and medium-term. In the long term, I think it’s clear that you should be thinking about selling these out of your portfolio at a profit...

August 1, 2022 @ 7:17 pm | Breaking News, Jubak Picks Portfolio |

I ended my recent post “This looks like the Bear Market rally I’ve been waiting for” on my subscription JubakAM.com site by saying “Enjoy the ride but look to sell shares of companies that look most exposed to the return of recession/high...

July 20, 2022 @ 11:06 pm | Breaking News, COP, Jubak Picks Portfolio, LNG, Volatility |

There are the base-load power plants that run all the time and meet the bulk of normal electricity demand. And then there are the power plants that are only intermittently called into service when demand spikes. In the United States the majority of the plants used to...

May 31, 2022 @ 7:44 pm | Breaking News, COP, Jubak Picks Portfolio, PXD |

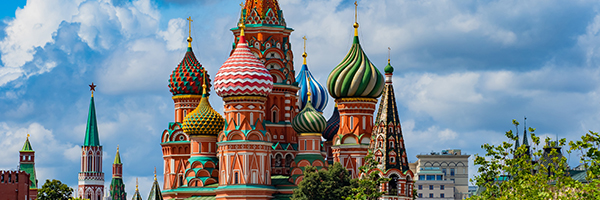

The European Union has finally found a way to agree on a partial ban on oil imports from Russia. The group has agreed to an immediate ban on imports arriving by sea. That covers about two-thirds of Russian imports. To get Hungary’s vote for the partial ban, the...

May 9, 2022 @ 10:02 pm | Breaking News, Dividend Income Portfolio, Jubak Picks Portfolio, PXD, You May Have Missed |

My one-hundredth-and-thirty-second YouTube video “Trend of the Week Give “Em the Cash” went up today. So far, so good this earnings season: oil and natural gas producers are holding the line on capital spending on new production, as they promised,...

May 3, 2022 @ 10:50 pm | Breaking News, COF, EQNR, Jubak Picks Portfolio, Jubak Top 50 Portfolio, LNG, PXD |

Normally at this time of year natural gas prices retreat and companies actually stash natural gas in storage for use during hurricane outages in the fall and winter heating season. Not this year, however. Today natural gas prices in the U.S. hit a new 18-year high. At...

April 21, 2022 @ 9:59 pm | Breaking News, Buy Hold Sell, COP, EQNR, Jubak Picks Portfolio, LNG, PXD |

Today, April 21, reports from a number of different sources are pointing to lower oil production–which will mean higher oil prices. Even from current levels. And oil prices are significantly higher in the past three weeks. At 3:00 p.m. New York time today U.S....

April 12, 2022 @ 7:26 pm | Breaking News |

As of noon New York time today, April 12, the Standard & Poor’s 500 was up 0.47% and the Dow Jones Industrial Average had gained 0.34%. The NASDAQ Composite was higher by 0.73% and the NASDAQ 100 had moved up by 0.67%. The small cap Russell 2000 had tacked...

April 7, 2022 @ 11:01 pm | Breaking News, Jubak Picks Portfolio |

My one-hundredth-and -nineteenth YouTube video “Time to buy oil on the dip” went up today. We’ve had a pretty good dip over the last few days in oil prices. I think that comes from a trading pullback from a quick run-up in prices, as well as optimism...

March 30, 2022 @ 7:22 pm | Breaking News |

Hopes for a cease fire in Ukraine and for serious peace talks between Russia and Ukraine took the stock indexes up yesterday and the price of oil and oil stocks down. News of renewed Russian shelling and that Russian troops were redeploying rather than withdrawing...

March 23, 2022 @ 7:49 pm | Buy, Buy Hold Sell |

Oil rallied again today with U.S. benchmark West Texas Intermediate up 4.79% on the day to $114.79 a barrel and international benchmark Brent up 5.12% to $121.39 a barrel. So, naturally, oil and gas equities stocks are up today. And the broader market is down. What...

March 8, 2022 @ 7:57 pm | ALB, Breaking News, COP, Jubak Picks Portfolio, Jubak Top 50 Portfolio, PXD |

The United States will ban imports of oil and natural gas from Russia, President Biden announced Tuesday. I’ve tried to pin down the exact timing and implementation of the ban (I don’t see these details in the executive order as released by the White...

February 24, 2022 @ 11:04 pm | Breaking News, Dividend Income Portfolio, PXD |

I’m starting up my videos again–this time using YouTube as a platform. My one-hundredth-and sixth YouTube video “Quick Pick Pioneer Natural Resources” went up today. This week my Quick Pick is Pioneer Natural Resources (PXD). I don’t like...

February 22, 2022 @ 7:08 pm | Breaking News |

Let me start off by making something very clear–the Russian de facto invasion of Ukraine is a very big deal for the people of Ukraine, the separatists regions, and the countries of Eastern Europe. I think we’re looking at the potential for thousands of...

February 18, 2022 @ 7:56 pm | Breaking News, COP, EQNR, Jubak Picks Portfolio, LNG, PXD |

If you believe as I do that one of Russian President Vladimir Putin’s goals in igniting the current conflict in Ukraine was to attempt to use Europe’s dependency on Russia natural gas to drive a wedge among NATO members, the most recent developments make a...

February 11, 2022 @ 7:28 pm | Breaking News, Buy Hold Sell, COP, EQNR, Jubak Picks Portfolio, LNG, PXD |

International benchmark Brent crude jumped as much as 4.7% to $95 a barrel for the first time since 2014. Brent was up 23.68% and trading at $94.77 at 3 p.m. New York time Friday. U.S. benchmark West Texas Intermediate, which normally trades below Brent in price, was...

February 4, 2022 @ 7:49 pm | Breaking News, COP, EQNR, Jubak Picks Portfolio, LNG, PXD |

On Thursday, Feburary 3, U.S. crude benchmark West Texas Intermediate rose above $90 a barrel–it closed at $90.87, up 0.60% for the day, for the first time since 2014. International benchmark Brent crude gained 0.42% to close at $91.53 a barrel. Of course, it...

January 21, 2022 @ 7:09 pm | Breaking News, Buy Hold Sell, COP, EQNR, LNG, PXD, Volatility, You May Have Missed |

I only recommend options on my subscription sites JubakAm.Com and JugglingWithknives.com. And this week on those sites I’ve closed the two VIX CALL Options I bought back on December 31 as protection (and potential profits) from an increase in market volatility...

November 16, 2021 @ 7:53 pm | Breaking News |

OPEC has decided that the current global economic recovery is very fragile and that the smart course is to raise production only gradually. The Organization of Petroleum Exporting Countries said the global oil market will switch from being under-supplied to...

January 5, 2021 @ 5:58 pm | Breaking News |

Today, January 5, Saudi Arabia shocked OPEC+ with a voluntary 1-million-barrel-per-day output cut. The announcement came after OPEC and Russia agreed to allow a 75,000 barrels a day increase in total production from Russia and Kazakhstan in February and March. On the...