March 4, 2021 @ 7:31 pm | Breaking News |

I’m not sure that it rises to the level of a “taper tantrum” but the financial markets wanted Fed chair Jerome Powell to signal that the central bank would increase its bond buying at the 10-year end of the yield curve in order to depress rising...

March 4, 2021 @ 7:20 pm | Breaking News |

I’m starting up my videos again–this time using YouTube as a platform. The thirteenth YouTube video “2 Hedges for All Your Market Worries” went up today. Please watch and subscribe to my YouTube channel. And like my video. You can see it...

March 4, 2021 @ 7:13 pm | Breaking News, Jubak Picks Portfolio |

Call this making sure we’re all on the same page. Yesterday in my YouTube video and in my latest addition to my Special Report: “Profit and Protect” I added the U.S. Copper Fund ETF (CPER) and the Invesco KBW Bank ETF (KBWB) to my Perfect Five ETF...

May 12, 2020 @ 10:40 pm | Breaking News |

On March 23, the Federal Reserve announced that it would create a facility to buy corporate bunds and ETFs tracking the corporate bond market. That facility remained an all-talk/no-action vehicle until today when the New York Federal Reserve Bank announced that its...

May 7, 2020 @ 7:39 pm | Breaking News |

The Fed funds futures market, which trades bets on where the Federal Reserve’s benchmark interest rates are headed, has rallied this week to send prices for futures contracts in early 2021 above 100. Above 100 traders are pricing in negative interest rates from...

January 9, 2020 @ 7:35 pm | Breaking News, Volatility, You May Have Missed |

Today in its semi-annual report Global Economic Prospect, the World Bank warned, again, of the risk of a new global debt crisis as a result of the biggest buildup in borrowing in the past 50 years. Of the four waves of debt accumulation since the 1970s, the current...

September 12, 2019 @ 8:03 pm | Breaking News |

If it had come to a formal vote, there’s a good chance that European Central Bank President Mario Draghi would have faced defeat in his efforts to revive quantitative easing at the central bank. But the bank doesn’t usually hold a formal vote on a issue...

August 1, 2019 @ 7:28 pm | Breaking News, Volatility, You May Have Missed |

So much for any hopes that the resumption of U.S-China trade talks would put an end to the tariff war in anything like the near term. The new round of talks only began on Wednesday, was adjourned after a day, and was scheduled to resume in Washington in September....

August 1, 2019 @ 7:21 pm | Breaking News, Volatility, You May Have Missed |

Can you connect the dots? No one in Washington seems to be willing to make the effort. On a day when the Federal Reserve said it would cut its benchmark interest rate by 25 basis points and end its efforts to sell some of the bonds in its own portfolio two months...

March 28, 2019 @ 7:16 pm | Breaking News, Volatility, You May Have Missed |

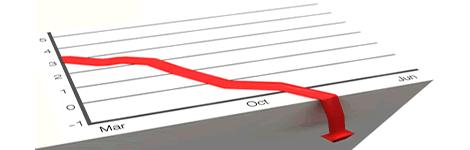

It’s all my fault. I go away for two days to tour colleges with my daughter, and global bond markets soar as everybody in the world decides to seek safety simultaneously. Today’s pause has very little to do with my return to my desk. The rise in bond...

January 2, 2019 @ 7:57 pm | Breaking News, Volatility, You May Have Missed |

China and other export-oriented Asian economies delivered really grim news on growth last night and yet U.S. stocks have refused to move into the red. As of 2:20 p.m. New York time on Thursday the Standard & Poor’s 500 index was up 0.07% The NASDAQ...

November 9, 2018 @ 6:35 pm | Breaking News, Volatility, You May Have Missed |

I’ve written more than once about my conviction–and consequent worry–that we’re headed for a global credit crunch sometime in the next three to four years. I’m looking for the kind of Minsky Moment that sees financial markets go into...

September 20, 2018 @ 6:53 pm | Breaking News, Leading Indicators, Volatility, You May Have Missed |

Remember back at the beginning of 2018 when bond investors and traders couldn’t agree on whether the Federal Reserve would raise interest rates two times, or three times or four times in the year? (It wound up being four.) Well, we’re looking at a replay...

August 2, 2018 @ 7:50 pm | Breaking News, Volatility, You May Have Missed |

Yesterday the Treasury Department said that it will raise long-term debt issuance to $78 billion this quarter. That would be an increase from the $73 billion in sales last quarter and the third consecutive quarterly increase. The increased sales of Treasury debt are...

March 13, 2018 @ 7:08 pm | Breaking News, You May Have Missed |

After a worrying 0.5% jump in January, headline inflation as measured by the Consumer Price Index increased by just 0.2% in February. That was right on the 0.2% mark expected by economists surveyed by Briefing.com. Core inflation, which excludes more volatile food and...

February 7, 2018 @ 6:08 pm | Breaking News |

With a pause in the Friday/Monday stock market rout, the bond market isn’t getting support from a flight to safety (at least for the moment) and worries specific to the bond market have remerged as the leading factor in bond yields. Today the yield on the...

January 12, 2018 @ 7:45 pm | Breaking News, Volatility |

Some mornings I have to dig for a lead new story. Other days I’ve got candidates crawling out of the woodwork like roaches in a dirty kitchen when the lights are off. Today I’ve got lots and lots of choices. I’m gong to begin with the bond market...

January 10, 2018 @ 6:31 pm | Breaking News, Volatility, You May Have Missed |

Just what an already jittery bond market needs: reports that senior Chinese officials reviewing the country’s purchases or U.S. Treasuries have recommended slowing of halting that buying. It’s not clear from these reports whether the recommendation is...

January 9, 2018 @ 7:15 pm | Breaking News, Dividend Income Portfolio, You May Have Missed |

The yield on the 10-year U.S. Treasury climbed 7 basis points today to 2.55%. That’s the highest yield since March. That prompted bond guru Bill Gross to declare that we have entered a confirmed bear market in bonds with the upward trend lines for bond prices of...

September 27, 2017 @ 6:27 pm | Breaking News |

The financial markets are taking Janet Yellen seriously. In a speech yesterday the Fed chair strongly supported an interest rate increase at the Federal Reserve’s December 13 meeting. Coming along with comments from other Fed governors, the markets have decided...

September 6, 2017 @ 6:59 pm | Breaking News, Volatility, You May Have Missed |

Please extend the greeting of your choice to the U.S. Congress, back in “action” today after a long August recess. This morning Democrats said they would vote for a disaster relief package for victims of Hurricane Harvey if Republicans attached the measure...

August 25, 2017 @ 6:56 pm | Breaking News |

If President Donald Trump reappoints current Federal Reserve chair Janet Yellen to a new term in February 2018, no one will be able to say truthfully that he didn’t know exactly what kind of chair he would be getting. Not after her speech today at the Kansas...

August 24, 2017 @ 7:19 pm | Breaking News, Volatility |

You wouldn’t know that there was anything to worry about from the U.S. stock market. So what that the President of the United States has threatened to shut down the government unless Congress funds The Wall. So what that the promised tax cuts so near and dear to...

March 14, 2017 @ 7:30 pm | Breaking News, Volatility |

Let me share a post that I put up last night on my paid sites about when the great bull market in bonds will finally turn into the great bear market in bonds. Yes, that’s sites. Plural. I’ve been busy building a second site, JugglingWithKnives.com, that...

March 13, 2017 @ 7:26 pm | Breaking News, Volatility |

With the Federal Reserve likely to raise interest rates at its Wednesday, Wall Street is re-thinking its assumptions about the Fed’s actions on rates for the rest of 2017. Way back in December when the U.S. central bank raised interest rates for the first time,...

February 15, 2017 @ 6:53 pm | Breaking News |

Inflation, as measured by the Consumer Price Index, rose in January by a larger than forecast 0.6%. That’s a pickup from the 0.3% rise in December and brings the 12-month inflation rate to 2.5%, the highest since March 2012. The core CPI, which excludes...

January 11, 2017 @ 7:07 pm | Breaking News, Dividend Income Portfolio |

If you had bought the stocks in my Dividend Portfolio on December 31, 2015–or when I added them to this portfolio during 2016 in the cases of Coach (COH), Qualcomm (QCOM), VanEck Vectors Preferred Securities (excluding Financials) ETF (PFXF), and Kinder Morgan...

November 14, 2016 @ 7:28 pm | Breaking News, Volatility |

The rout in global bonds continued today. The yield on the 10-year U.S. Treasury climbed 7 basis points to 2.22% as of 3 p.m. New York time. That’s the highest level since January and comes after a jump of 37 basis points last week. Yields on the 10-year German...

September 9, 2016 @ 7:41 pm | Breaking News |

I’ve been waiting seemingly forever for the financial markets to show some acknowledgement that central bank stimulus policies can’t go on until the sun turns into a dark cinder. For how long have I been waiting? More than a year certainly. But each time I...

July 12, 2016 @ 7:40 pm | Jubak Picks Portfolio |

Update July 12. The yield on 10-year Treasuries rose to 1.52%, the highest level this month (and prices fell). Last week the yield on the 10-year Treasury hit a record low of 1.318%. The climb in Treasury yields is likely to be temporary, in my opinion. The market is...