And Merry Christmas! to you too. The stock market delivered a lump of coal on Christmas Eve. (Does this mean the financial markets are part of the dastardly war on Christmas? Say it ain’t so, Goldman Sachs!)

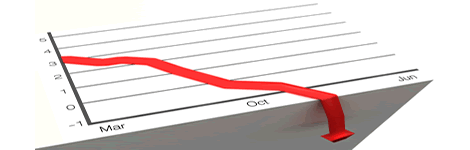

The Standard & Poor’s 500 index closed down 2.71% at 2361.10 moving into bear market territory.

The Dow Jones Industrial Average fell 653 points–which sounds really scary until you realize that with the Dow above 20,000, 653 points is “just” 2.91% and at which point the drop seems merely scary.

The NASDAQ Composite was off 2.21%–less I’d note than either the S&P 500 or the Dow Industrials. But then the NASDAQ fell into a bear market last week.

The small cap Russell 2000 turned in the best performance of the day, dropping only 1.95%. But the Russell was the first of these indexes to enter bear market territory.

I’m not sure the market needed an excuse to tumble but it got not one but two.

Treasury Secretary Steve Mnuchin made a series of calls to bank CEOs, checking to see that they have adequate liquidity. Reasonable. But then he tweeted that he’d done that. Oh, no, Steve. You make these calls in confidence and then you keep the calls secret. You don’t remind the market that you, the Treasury Secretary, are worried about liquidity in the banking system. (Which then makes you’re reassurance that banks have plenty of liquidity something less than reassuring.) And you especially don’t send out this tweet the day before Christmas when market volume and liquidity are already low and everybody is rushing to shut the office. What do you think the reaction is going to be to a piece of news like that? Choice 1: A measured called to get everybody back to the office, making calls to see if there is any reason to worry about the big banks, and then a calm discussion of strategies or Choice 2: An order to sell anything that’s not nailed down ahead of tomorrow’s market holiday.

It didn’t help that a tweet from Mnuchin reminded the financial markets of the President’s propensity to make policy via Twitter. (And raised the reasonable question “Does anybody in this administration know what they’re doing on financial policy?)

Nor did it help that President Donald Trump continued his war on the Federal Reserve via Twitter today. Here’s the President’s 10:55 a.m. New York time tweet: “The only problem our economy has is the Fed. They don’t have a feel for the Market, they don’t understand necessary Trade Wars or Strong Dollars or even Democrat Shutdowns over Borders. The Fed is like a powerful golfer who can’t score because he has no touch – he can’t putt!”

Again, the market had two choices on how to regard that message. Choice 1: The President is right and the Fed is about to send the economy into recession or Choice 2: The President is waging a deeply unsettling war with the Federal Reserve that argues against any kind of stable financial policy from the White House.

And I’d note that the financial markets know that the current government shutdown over a decision to spend/not spend $5 billion on the President’s border wall (or steel slats) is merely a dry run for the battle over raising the Federal government’s debt limit that looms on the calendar in March. That, on current form, promises to be really ugly.

On Friday on my subscription JubakAM.com site in my revised Special Report Protect Your Portfolio without Selling Your Portfolio I recommended buying puts on Boeing (BA) down 3.41% today and Amazon (AMZN) down 2.43% today. I also recommended holding off on buying puts on Microsoft (MSFT), Netflix (NFLX), and Alphabet (GOOG) until we saw if the bounce levels on the stocks would hold. They haven’t and I regret Friday’s caution. Microsoft (MSFT) closed down 4.17% today to $94.13. Netflix (NFLX) fell 5.08% to $237.88. Alphabet (GOOG) was lower by just 0.34% to $976.22. (Readers of this free site have received email offers to subscribe to my JubakAM.com site at 20% off–if you’ve lost track of those emails, another is scheduled for Thursday. Those offers will let you get JubakAM.com and my bear market protection special report for 20% off.)

In an effort to suggest that you not jump off a cliff after today’s drop, I’d remind you that stocks have retreated only to the level of April 2017. As rewinds go this one isn’t yet enough to signal the end of the world.