This morning the November jobs report came in softer than expected–and that pretty much removed the last factor pushing the Federal Reserve toward aggressively raising interest rates in 2019.

For November the economy added 155,000 jobs. That is still a strong number–and indicates that the real economy isn’t about to fall off a cliff whatever the financial markets might be signaling. But the addition of 155,000 jobs was still short of the 189,000 expected by economists surveyed by Briefing.com. Government statisticians also revised the October job number lower to 237,000 from the 250,000 reported earlier.

Importantly for the Fed’s interest rate decisions, average hourly earnings were up 0.2% in November from October. That matched the October monthly increase. But was, again, short of economist projections of a gain of 0.3% in November. For the last 12 months the increase in average hourly earnings remained at 3.1% in November, unchanged for the 12-month reading for the period that ended in October.

The 3.1% gain in average hourly earnings is high enough to have prompted concern from the Federal Reserve that wage inflation had finally arrived–which would be a strong reason to raise interest rates aggressively. But the fact that the 3.1% rate is unchanged from October is likely to be a relief to the Fed since it means the economy hasn’t reached a point of run-away wage inflation.

This report is about as good as the market could have hoped for at this point–strong enough to indicate that the economy isn’t rushing toward recession but weak enough to give the Federal Reserve reason to hold off on interest rate increases in 2019. The CME FedWatch tool puts the odds of an interest rate increase at the Fed’s December 19 meeting at 74.9%. That’s an increase from the 70.6% odds yesterday but down from the 82.7% odds on November 30. The market is of the opinion that the Fed will raise interest rates at its December meeting and then, the market hopes, indicate that it is done for a while.

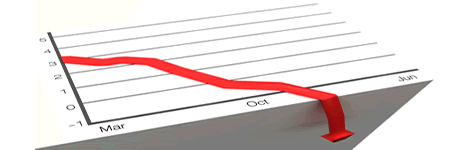

Stocks haven’t been impressed so far today, however, choosing instead of focus on the possibility of a trade war between the United States and China. As of 2:30 p.m. New York time the Standard & Poor’s 500 was down 2.09% and the Dow Jones Industrial Average was lower by 2.12%. Technology shares, which had held up well in yesterday’s downturn, were especially weak today on trade fears with the NASDAQ Composite off 2.64%. Amazon (AMZN) was lower by 3.01%; Netflix (NFLX) was down 4.78%, and Nvidia (NVDA) fell 6.26%. The Technology Select Sector SPDR (XLK) was down 3.70%. Financials, which led the slaughter yesterday, were down again today with the Financial Select Sector SpDR (XLF) lower by 1.93%.

The CBOE S&P 500 Volatility Index (VIX) climbed again today, with a gain of 8.49% to 22.99 but the volatile volatility index is still a long way from panic territory.

The U.S. dollar fell with the Dollar Spot Index off 0.26%. The prospect of fewer interest rate increases from the Fed lessens the attractiveness of the dollar.